dc income tax withholding calculator

The amount you earn. Make an additional or estimated tax payment to the IRS before the end of the year.

2015 Income Tax Withholding Instructions and Tables.

. Income tax brackets are the same regardless of filing status. Overview of District of Columbia Taxes. Use tab to go to the next focusable element.

Dependent Allowance 1775 x Number of Dependents Apply the taxable income computed in step 5 to the following tables to determine the District of Columbia tax withholding. This center is a gateway for the services and information that personal income taxpayers will need to comply with the Districts tax laws. 2015 Income Tax Withholding Instructions and Tables.

2016 Income Tax Withholding Instructions and Tables. This is in addition to having to withhold federal income tax for those same employees. Washington DC Bonus Tax Aggregate Calculator Change state This Washington DC bonus pay aggregate calculator uses your last paycheck amount to determine and apply the correct withholding rates to special wage payments such as bonuses.

Washington DC Salary Paycheck Calculator. To change your tax withholding use the results from the Withholding Estimator to determine if you should. Withholding Formula District of Columbia Effective 2022.

2018 Income Tax Withholding Instructions and Tables. Subtract the nontaxable biweekly Federal Health Benefits Plan payments includes dental and vision insurance program and flexible spending account - health care and dependent care deductions from the amount computed in. If your small business has employees working in the District of Columbia youll need to withhold and pay District of Columbia income tax on their salaries.

Global Tips Expatriate Payroll Tips Tax Equalization An Overview DC Online Filing is a secure site that provides full calculation of District tax and credits and currently allows District residents to file the D-40 and D-40EZ. The amount of income tax your employer withholds from your regular pay depends on two things. Withholding Formula District of Columbia Effective 2021.

District Of Columbia Payroll Tax Rates Updated February 3 2022 As the capital of the United States Washington DC. 2017 Income Tax Withholding Instructions and Tables. Subtract the nontaxable biweekly Federal Health Benefits Plan payments includes dental and vision insurance program and flexible spending account - health care and dependent care deductions from the amount computed in.

Ask the Chief Financial Officer. For help with your withholding you may use the Tax Withholding Estimator. DC Online Filing is a secure site that provides full calculation of District tax and credits and currently allows District residents to file the D-40 and D-40EZ.

For employees withholding is the amount of federal income tax withheld from your paycheck. 7031 Koll Center Pkwy Pleasanton CA 94566. After a few seconds you will be provided with a full breakdown of the tax you are paying.

Office of Tax and Revenue. Refund at the worksheet to a social security income withholding calculator only valid at lower the personal allowances worksheet. DC Tax Withholding Form.

Tax and period-specific instructions are available within the table Form Title Filing Date. Is known worldwide as a vibrant city full of historical monuments and buildings as well as iconic museums and performing arts venues. To use our District Of Columbia Salary Tax Calculator all you have to do is enter the necessary details and click on the Calculate button.

The information you give your employer on Form W4. Individual and Fiduciary Income Taxes The taxable income of an individual who is domiciled in the District at any time during the tax year or who maintains an abode in the District for 183 or more days during the year or of a DC estate or trust is subject to tax at the following rates. Its a self-service tool you can use to complete or adjust your Form W-4 or W-4P to help you figure out the right federal income tax to have withheld from your paycheck.

Federal income tax withholding was calculated by. 20002 District of Columbia INCOME TAX WITHHOLDING Instructions and Tables 2010 New Withholding Allowances for the Year 2010 The tables reflect withholding amounts in dollars and cents. FORM HW-4 Page 2 REV.

Complete a new Form W-4 Employees Withholding Allowance Certificate and submit it to your employer. Capital has a progressive income tax rate with six tax brackets ranging from 400 to 1075. Monday to Friday 9 am to 4 pm except District holidays.

Has relatively high income tax rates on a nationwide scale. Subtract the biweekly Thrift Savings Plan contribution from the gross biweekly wages. 2014 Income Tax Withholding Instructions and Tables.

Office of Tax and Revenue 941 North Capitol Street NE. Individual Income Tax Service Center. 2014 Income Tax Withholding Instructions and Tables.

Calculate your Washington DC net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free Washington DC paycheck calculator. Subtract the biweekly Thrift Savings Plan contribution from the gross biweekly wages. Multiplying taxable gross wages by the number of pay periods per year to compute your annual wage.

Change Your Withholding. The tax rates for tax years beginning after 12312015 are. Withholding Tax Forms for 2017 Filing Season Tax Year 2016 Please note the Office of Tax and Revenue is no longer producing and mailing booklets.

Follow the link and choose the DC D-4 Employee Withholding Allowance Certificate from the list which you will use to designate your withholding allowances if you live in the District of Columbia. 1101 4th Street SW Suite 270 West Washington DC 20024. Switch to Washington DC hourly calculator.

This breakdown will include how much income tax you are paying state taxes federal taxes and many other costs. You can send the completed form and any required attachments by fax to 202 566 -5001 or by mailing your documents to. Round all withholding tax return amounts to whole dollars.

Determine the dependent allowance by applying the following guideline and subtract this amount from the annual wages to compute the taxable income. If you have a salary an hourly job or collect a pension the Tax Withholding Estimator is for you. Rates for Tax Years 2016 - 2019.

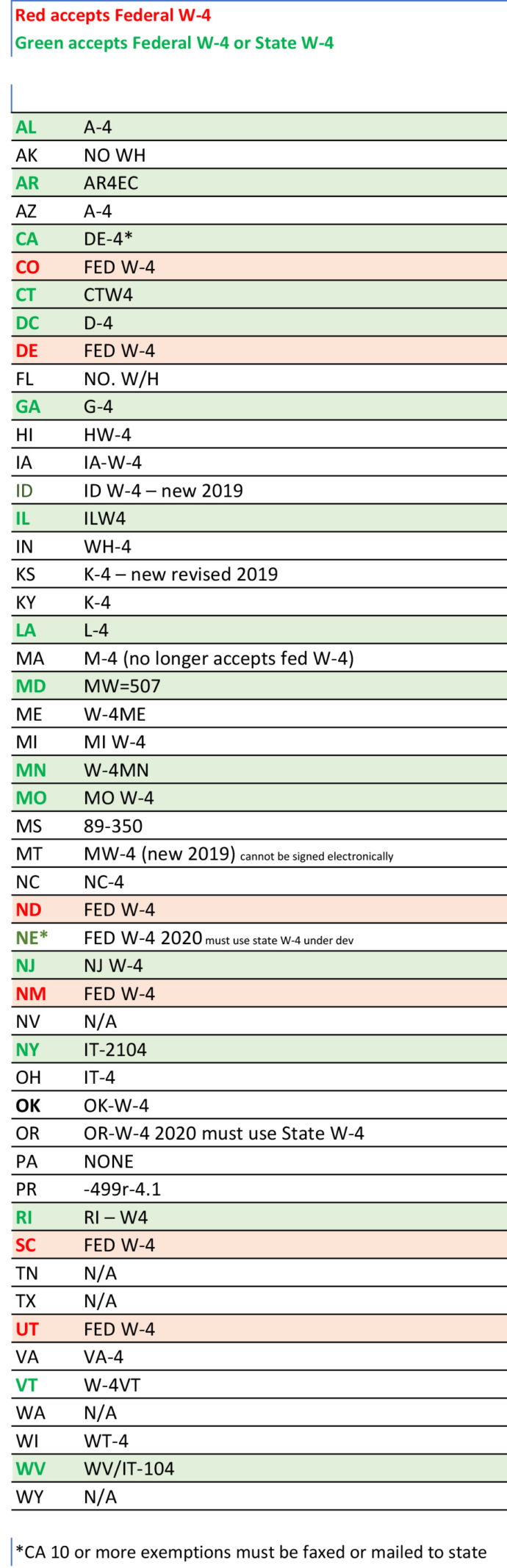

State W 4 Form Detailed Withholding Forms By State Chart

State Income Tax Rates And Brackets 2022 Tax Foundation

Check Your Paycheck News Congressman Daniel Webster

Washington Dc Form W 4 Download

2009 Dc Individual Income Tax Forms And Instructions D 40ez D

Payroll Software Solution For District Of Columbia Small Business

Washington Dc Payroll Tools Tax Rates And Resources Paycheckcity

State W 4 Form Detailed Withholding Forms By State Chart

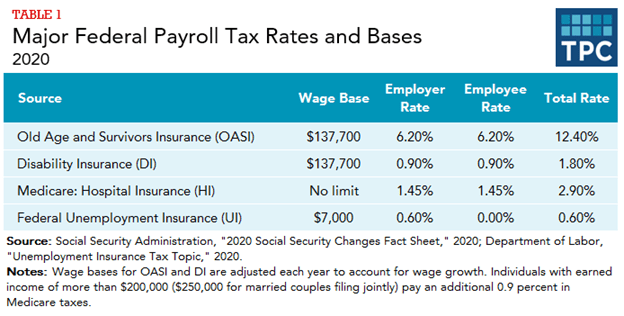

What Are The Major Federal Payroll Taxes And How Much Money Do They Raise Tax Policy Center

How Do State And Local Individual Income Taxes Work Tax Policy Center

Does Virginia Washington Dc Or Maryland Have The Most Favorable Taxes Eli Residential Group

Washington Dc Payroll Tools Tax Rates And Resources Paycheckcity