option to tax unit

However the ability to sign these forms electronically has been made permanent. In this case please send both forms to the appropriate VAT Registration Unit VRU.

/dotdash_Final_Get_the_Most_Out_of_Employee_Stock_Options_Oct_2020-01-e28cc3504d694dcaaa7a45dfed666f0b.jpg)

Get The Most Out Of Employee Stock Options

Update on delays at Option to Tax Unit.

. Option to tax notifications can be emailed to optiontotaxnationalunithmrcgovuk. Please bear this in mind and if there is likely to be an urgent need to evidence that an option to tax has been notified we would recommend that the option is. Under the anti-avoidance provision the grantors option to tax is disapplied where the property is or is intended or expected to become a capital goods scheme CGS item for the grantor or the.

Get all the tax advice you need At Dyer Co were a professional team of Chartered Accountants that can help you save money whilst complying fully with legislation and staying on the right side of the law. However it might be worth doing this in advance of selling a commercial property because the OTT Unit can take about four weeks to reply to such requests. While measures to stop the spread of coronavirus are in place please only write to HMRC about opting to tax if youre unable to send an email.

The timing of submission is important. Apply for permission to opt to tax land or buildings Use form VAT1614H to apply for permission to opt land or buildings for VAT purposes. HMRC - Option To Tax Unit.

A landowner or prospective landowner will exercise the option to tax over land with effect from a current or future date. We have recently been advised by HMRCs OTT unit that they are currently working to a target of 120 working days to process OTT notifications. Option to Tax Unit new fax number All on-line forms dealing with options to tax and revocations of options are currently being updated with the new fax number of the Option to Tax Unit which is.

For the address of the VRU covering your postcode phone our advice service on. The VAT OTT contact details are as follows. We recently shared that we had been advised by HMRCs OTT unit that they were working to a target of 120 working days to process OTT notifications.

Fax 03000 516 251 If you need to fax documents to the Option to Tax Unit make sure you are using the correct number. A taxpayer can request a copy of the OTT elections it has made in the past by contacting HMRCs Option to Tax Unit in Glasgow. This means that no.

We can assist you if you do have any questions about option to tax and completing the relevant form VAT 1614A. However it should be noted that prior to 1 March 1995 if the annual value of rents was not expected to exceed 20K there was no need to formally notify an option to tax. Opting to tax is a two stage process.

Income Tax Reporting Options Use the Manage Tax Reporting and Withholding Tax Options task to manage the following income tax reporting options for an invoice business unit. The first step is for your client to check with HMRCs National Option to Tax Unit whether they hold a record of the client having opted to tax their interest in the property. The relevant form to send to HMRCs Option to Tax Unit in Glasgow is VAT1614A which means that the landlord does not need HMRCs permission to opt because he has not made any previous exempt supplies in relation to the building see below re.

This is the date you actually receive your stocks and it may be different from your vesting date. Choosing the date you take possession of your stock can help you know when youll have to pay tax on the stock issuance but few plans offer this perk. 123 St Vincent Street GLASGOW G2 5EA.

Use supplier tax region. Use combined filing program. HM Revenue and Customs Option to Tax National Unit 123 St Vincent Street GLASGOW G2 5EA Phone 0300 200 3700 Scanned copies of this form can be e-mailed to.

The time limit for notifying an option to tax has returned to 30 days from 1 August 2021. Normal due diligence by buyers solicitors should always ask for confirmation proof of option to tax from the vendor. Revoke an option to tax after 20 years have passed Use form.

Following this we were advised by HMRC staff that the delay was 6 months. Importers are temporarily no longer able to submit forms to the National Import Reliefs Unit by post. Include your EORI number in the email or if you do not have one your name and address.

Put Options. You can email notifications to optiontotaxnationalunithmrcgovuk. If a put is exercised and the buyer owned the underlying securities the puts premium and commissions are added to the cost basis of the shares.

Put options receive a similar treatment. For tax planning purposes some restricted stock unit plans allow you to choose your grant date. HMRCs Option to Tax Unit HMRC will acknowledge all elections in writing and this is important because it gives the opter proof to provide to either their purchaser or tenants that an election has been made and therefore a 20 VAT charge is correct.

They should be emailed to niruhmrcgovuk. 6FDQQHG FRSLHV RI WKLV IRUP FDQ EH H PDLOHG WR RSWLRQWRWDQDWLRQDOXQLWKPUF JRY XN. Delays at Option to Tax Unit.

Option to Tax National Unit Cotton House 7 Cochrane Street Glasgow G1 1GY Phone 0141 285 4174 4175 Fax 0141 285 4423 4454 Unless you are registering for VAT and also want to opt to tax. 12 The effect an option to tax has Supplies of land and buildings such as freehold sales leasing or renting are normally exempt from VAT. Option to Tax National Unit 123 St Vincent Street GLASGOW G2 5EA Phone 0300 200 3700 Scanned copies of this form can be e-mailed to.

During the early stages of COVID-19 we allowed businesses or agents to notify an option to tax with electronic signatures. Opting to tax land and buildings - notification of a real estate election. Option to Tax National Unit.

So You Have Stock Compensation And Your Form W 2 Just Arrived Now What The Mystockoptions Blog

Tax Administration Responses To Covid 19 Measures Taken To Support Taxpayers

/dotdash_Final_Get_the_Most_Out_of_Employee_Stock_Options_Oct_2020-01-e28cc3504d694dcaaa7a45dfed666f0b.jpg)

Get The Most Out Of Employee Stock Options

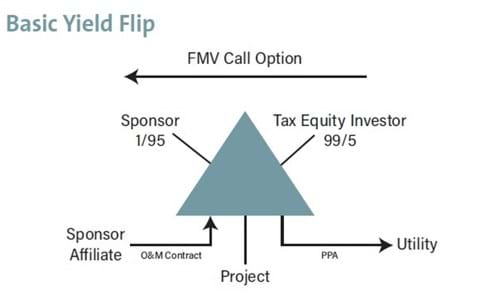

Solar Tax Equity Structures Norton Rose Fulbright December 2021

Restricted Stock Awards Rsas Vs Restricted Stock Units Rsus Carta

:max_bytes(150000):strip_icc()/dotdash_Final_Get_the_Most_Out_of_Employee_Stock_Options_Oct_2020-02-e2a3aeb7d91347578e72df8195d0e8f0.jpg)

Get The Most Out Of Employee Stock Options

Effect Of Taxes On Monopoly Equilibrium With Diagram

Determining Household Size For Medicaid And The Children S Health Insurance Program Health Reform Beyond The Basics

/dotdash_Final_Get_the_Most_Out_of_Employee_Stock_Options_Oct_2020-01-e28cc3504d694dcaaa7a45dfed666f0b.jpg)